The rise of e-payment systems has transformed how we interact with money, from traditional banking to the advent of innovative technologies like digital wallets and biometric payments. This article explores the evolution of e-payment, its milestones, and its future direction.

What is e-Payment?

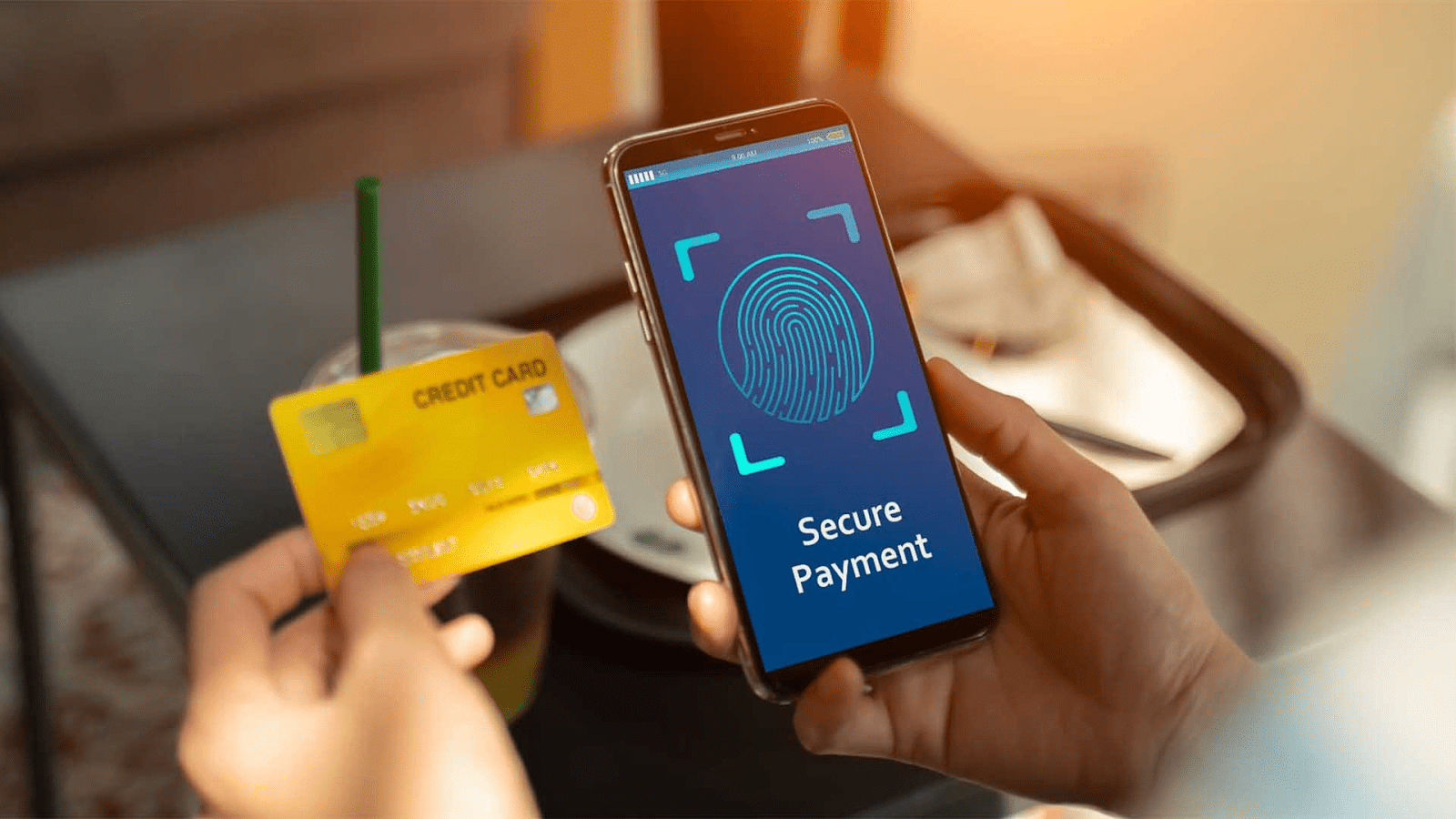

Electronic payment (e-payment) refers to transactions conducted digitally using electronic systems. It includes payments made through:

- Credit and debit cards.

- Digital wallets.

- Mobile payment platforms.

- Biometric authentication systems.

E-payment systems are built on technologies that ensure security, speed, and convenience for both consumers and businesses.

The Early Days of e-Payment

Introduction of Online Banking

The journey of e-payment began with online banking in the 1990s, enabling customers to transfer funds and pay bills through internet-connected platforms.

The Rise of Credit and Debit Cards

Plastic cards became a revolutionary tool for cashless transactions, forming the backbone of modern e-payment systems.

The Emergence of Digital Wallets

Digital wallets store payment information electronically, allowing users to make payments seamlessly via smartphones, tablets, or computers.

Benefits of Digital Wallets

1. Convenience: Enables quick and easy transactions.

2. Security: Uses encryption and tokenization to protect user data.

3. Versatility: Supports in-store, online, and peer-to-peer payments.

Biometric Payments: A New Frontier

Biometric payments leverage unique biological traits for authentication, ensuring a higher level of security and user convenience. A user’s biometric data is scanned and matched with stored data to authenticate and approve transactions. The types of biometrics used include:

1. Fingerprint Recognition: Common in mobile payment apps.

2. Facial Recognition: Used by systems for secure transactions.

3. Voice Recognition: An emerging technology for hands-free payments.

Key Benefits of Biometric Payments

1. Enhanced Security:

Reduces fraud risks by using unique, hard-to-replicate biological traits.

2. Improved User Experience:

Eliminates the need for passwords or PINs, making transactions seamless.

3. Faster Transactions:

Speeds up payment processes by replacing manual authentication methods.

e-Payment Systems Around the World

Asia’s Dominance in Digital Payments

Countries like China and India lead the e-payment revolution, driven by QR codes and mobile wallets.

Innovations in Europe and the U.S.

Contactless payments and wearable devices are reshaping e-payment trends.

The Rise of E-Payment in Emerging Markets

Affordable mobile technologies are driving adoption in regions like Africa and Latin America.

How e-Payment Enhances Consumer and Business Experiences

For Consumers:

- Convenience: Simplifies payments anytime, anywhere.

- Speed: Reduces waiting times at checkout.

For Businesses:

- Efficiency: Automates payment processing and reduces cash-handling costs.

- Data Insights: Provides analytics for better decision-making.